Market structures refer to intertwined features of the market that include number and comparative strength of buyers and sellers and depth of collusion among them. Other aspects that help to define a market structure are the extent of product differentiation, level and forms of competition, and easiness of entry into and exit from the subject market. Market structure thus describes the degree of competition felt by businesses in the industry. Market structures dictate products sold, easiness of entry into and exit from the industry, and volume of information available for the subject industry. Stakeholders, particularly the government and regulators, must thoroughly comprehend active market structure types in their locality in order to understand implications of any actions pursued. Failure to understand the market structure by the government may lead to eventual suffocation and death of an enterprise and this can be detrimental to the economy and wellbeing of the community.

Perfect competition occurs when several small firms compete against each other. Perfect competition market structure is marked by many sellers and buyers. Firms are obliged to accept a market price as several competitors exist. Monopoly is the second market structure to be explored. A monopoly refers to a firm that lacks competitors in its industry. In order to increase profits, a monopolistic firm lowers its output to raise prices. Oligopoly is a market structure composed of few large firms. Oligopolistic firms produce a similar product for sale and compete heavily for market dominance. Entry into an oligopolistic market is difficult because of a high start-up cost and control of strategic raw material. Oligopolistic firms can collude to create a monopolistic atmosphere in the market.

Lastly, monopolistic competition refers to a market structure that has many sellers. The monopolistic competition differs from perfect competition in that firms concerned sell branded products and there is easiness of entry into and exit from the industry.

Identify One Real-Life Example of a Market Structure in Your Local City and Relate Your Example to Each of the Characteristics of the Market

The telecommunication industry in the New York City is oligopolistic by nature. There are few companies that command the market for the cell phone telecommunication service. Telecommunication firms have a heavy influence on the price and other areas of the market. Firms in the mobile telephony industry in the New York City are less concentrated compared to a monopoly, but are increasingly concentrated when juxtaposed with those of a perfect competition market structure.

Firms in the New York City offer similar services, which include cell phone communication network, internet access to internet-enabled cell phones, and messaging services. These characteristics provide for heavy interdependence that spurs competition in non-price-oriented areas such as advertising.

This scenario exists because of high start-up costs such as putting up infrastructure and hiring expert personnel. Firms in the mobile telephony industry always try to outdo each other by creating offers and basing their competition on product differentiation. AT&T stands out by means of employing cutting edge technology such as 4G. Firms in the mobile telephony keep exact information of the market under control. Competition among the mobile telephony firms helps to drive prices lower. However, prices are relatively stable because price war will eventually hurt the financial health of the firm although this can be a benefit for consumers. Mobile telephony firms in the New York City have exclusive control over several patented technologies they implement.

Another aspect that characterizes mobile telephony firms in the New York City as oligopolistic is exclusive dealerships established by respective companies with suppliers with an intent to enjoy lower prices from suppliers. Lower prices from suppliers and partners help a firm to charge lower price that potential new entrants in the industry find prohibitive.

How High Entry Barriers into a Market Will Influence Long-Run Profitability of the Firms

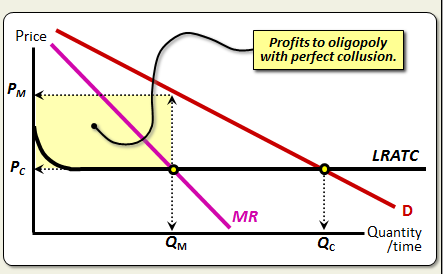

There are two aspects to explore: the first case is when firms compete while the second case is when companies collude. The graph below clearly depicts oligopolistic firms like in the mobile telephony industry discussed above competing with one another. In the scenario of competition, as shown below, price cutting results in lowering a price to Pc and increasing total output to Qc. Perfect collusion among companies results in higher prices of Pm and a reduced market output of Qm.

Graph 1.

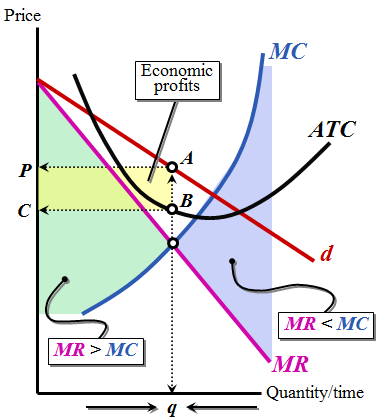

High entry barriers that affect oligopolistic firms mean that firms will make profits between Pc-Pm in the long run. The second market structure with high entry barriers is the monopolistic market. Monopolistic firms derive monopoly power from government regulation, control of strategic resource, and marketing advantage. From the graph below, it is evident that one producer of the product exists in a monopolistic market and the market demand curve is the monopolist demand curve. The monopolistic firm will increase its output until marginal revenue equals marginal cost in a bid to maximize profits. The monopolistic firm can enjoy long-term profits as high entry barriers inhibit competitors entry. However, the monopolistic firm will incur losses when the demand curve exceeds likely output rates and the ATC is above the demand curve.

Graph 2.

The Competitive Pressures that Are Present in Markets with High Barriers to Entry

Price discrimination is a dominant competitive pressure on firms operating in markets marked with high barriers of entry. Price discrimination is a scenario when a producer charges different prices for the same product. Producers or sellers must identify and separate a minimum of two groups with different elasticity of demand in order to profit from price segregation. In addition to the above requirement, sellers must make sure that buyers that purchase goods at a low price do not resell them to consumers that are charged higher prices. Groups with highly inelastic demand are billed high prices while the category with increasingly elastic demand is billed low prices. Since more output is yielded in overall, allocative efficiency is increased under price discrimination. In order to control reselling, a firm can categorize its consumers into groups with varying demand elasticity. In the above case, the firm can enhance total gains from trade and allow production in areas where production would be infeasible. The overall effect is that producer surplus is enhanced whereas total consumer surplus is decreased.

Another competitive pressure, particularly affecting market structures with heavy barriers to entry such as monopoly, include rent-seeking. Rent-seeking refers to working to play a part of the producer or consumer surplus or economic profit. For example, a monopoly makes profit by playing the role of the consumer itself. Furthermore, rent-seeking behavior may involve increasing resources to get governmental protections such as quotas and tariffs that advantage a limited set of producers.

The third competitive pressure lies in the oligopolistic market structures that experience kinked demand curves. The kinked demand curve posits that if a single firm increases prices, rival firms in the subject market structure will not respond, but will react by lowering prices if rival firms lower prices. It is a price war in a kinked demand curve for oligopolistic firms. In a kinked demand curve situation, increasing the price slightly above the market price will result in a large decline in quantity demanded. Large price cuts result in a slightly higher demand for the product sold. Therefore, it makes little significance whether to lower or increase the price beyond the market price in a bid to gain an advantage over competitors in a high barrier for entry market structure such as oligopoly.

Another competitive pressure for restrictive market structures occurs when there is a dominant firm in an oligopolistic industry. In this variation of the oligopolistic market structure, one main firm that enjoys economies of scale over rival firms sets prices for others. The dominant firm behaves as a monopoly making the remaining firms price-takers. The main firm will set the price where MR=MC.

Competitive pressure also happens in an oligopolistic environment in which firms collude. Collusion in an oligopolistic environment is when firms decide to avoid certain competitive practices, especially price reductions. In the above case, oligopolistic firms limit output to the monopoly level. In such monopoly, MR=MC. The collusion arrangement allows a market price to be set at a monopoly level with all firms reaping monopoly profits. A cartel is a product of collusive arrangement. In a cartel, sellers manage supply decisions in a bid to maximize joint profits of members.

Finally, another competitive pressure occurs when firms in an oligopolistic-oriented environment choose to compete by setting their prices independently. The above case results in the market price being pushed to a competitive price as all firms seek to reduce the price charged as much as possible in a bid to attract customers. The result of the above behavior is that firms charging prices at a competitive price will experience zero demand. The zero profit principle is active when oligopolistic firms choose not to collude. There exists an inducement to cheat among oligopolistic firms. For example, if there is an unidentifiable price cut, an oligopolistic firm pursuing price cuts is likely to attract more customers from rivals and even from its clients who would not purchase the commodity at a previous high price.

The Price Elasticity of Demand in Each Market Structure and Its Effect on Pricing of Its Products in Each Market

Price elasticity of demand refers to a metric that computes responsiveness of demand for a product after a change in price of the commodity. First, in a perfect competition, firms experience unit elasticity of demand. Unit elasticity of demand happens when there is, for example, 13% variation in price that results in a similar percentage change in quantity demanded. Unit elasticity of demand implies that firms in a perfect market structure should price their products at the market price as any slight increase in price will see buyers switching to rival firms. Unit elasticity of demand implies high availability of alternatives and close substitutes. The impact is that these firms are essentially price-takers. PED=1.

Secondly, in a monopolistic market structure, price elasticity of demand is perfectly inelastic. The implication is that demand will not change at all even if price varies. The demand curve is vertical for monopolistic firms. The above realization makes monopolistic firms price-givers. Such monopolistic firms can charge higher prices for their products and make supernormal profits. PED=0.

Thirdly, in an oligopolistic market structure, price elasticity of demand tends to be elastic. In this scenario, demand varies disproportionately to adjustment in price charged. In this market structure, it becomes feasible to operate at market or industry prevailing price. For instance, a 7% increase in price charged for a product results in 28 % decline in demand. A good case is a kinked demand curve situation when increasing the price slightly above the market price will result in a large decline in quantity demanded. Large price cuts result in slightly more demand for the product sold. The above feature makes oligopolistic markets highly fluid, PED>1.

Lastly, monopolistic firms experience price elasticity of demand that is inelastic in nature. Inelastic PED implies that the PED is between 0 and 1. Thus, change in demand from X to Y is less than the percentage variation in price. Clearly, the PED indicates that these firms fluctuate in traits between monopoly and perfect competition market structures. Therefore, firms in monopolistic competition can adjust the price accordingly, having pursued contingency measures such as product differentiation and brand loyalty, among others, without being sensitive to competitors moves. PED=0-1.

How the Role of the Government Affects Each Market Structures Ability to Price Its Products

In perfect competition, governments role is greatly limited to providing sufficient information about the market. There is no explicit governmental interference. The governments mandate is to ensure that the market remains barrier free, start-up costs are not high, and no one controls essential materials.

In the monopolistic market structure, the government has huge interest in the firms and greatly regulates the industry. The government creates barriers for entry by controlling the licensing process, which can include longer approval periods, control of strategic resources, and patenting of required technology, among others. The government can charge higher taxes or demand protection for the industry concerned. The government can affect price controls to protect citizens from the evil of monopolistic firms).

Thirdly, oligopolistic firms experience government regulation as they are often concerned with critical sectors such as telecommunication, power generation and distribution, and petroleum industry, among others. The government regulates ownership criteria and fees that can be charged. Like the case of the mobile telephony, communication authorities regulate mobile termination rates between telecommunication providers to protect consumers and minimize monopolistic tendencies of the subject firms. Lastly, in the monopolistic competition, the government plays a huge role through regulators as most firms in the monopolistic competition market structure tend to embrace capitalism. The government greatly regulates firms in this market structure through taxation, placement of quality standards to be met, and licensing among other instruments.

The Effect of International Trade on Each Market Structure

In the perfect competition market structure, international trade heralds entry of more players in the industry further increasing consumer choice of similar products. Since this market type has easy entry and exit of firms, local firms may exit the market in order to venture in another economy that is profit-promising and vice versa. Mass exit of local firms may leave consumers in the subject country exposed to exploitation while mass entry of new firms may imply better products at even lower prices (Bailey, Olson, & Wonnacott, 1980). For monopolistic firms, international trade means little, depending on existing barriers, but more so if two trading economies differ greatly. However, international trade may avail the alternative to local citizens where monopolistic firms exist. It is imperative to account for the fact that prices charged may be even higher than those of the local monopoly, but what may vary is quantity and quality of the product traded).

Thirdly, for oligopolistic firms, international trade presents them with new avenues to expand dominance and mergers. International trade often results in an oligopolistic firm buying a stake in another firm or being bought by a new entrant. Merging and buyout are very common in mobile telephony, internet-based firms, petroleum industry, and insurance industry among others. Oligopolistic firms have a tendency of trying to dominate other firms and mergers present a feasible option. As such, international trade has little impact on the price charged in this market as well as on quality and quantity of products traded.

Lastly, for monopolistic competition firms international trade has a huge impact on their operations and products churned out. Entry of new firms calls for more advertisement, more product differentiation, and price adjustment. Firms in the monopolistic competition are sensitive to international trade, especially when trying to consolidate existing market before attempting to venture into foreign markets.

Conclusion

From the discussion above, it is evident that stakeholders, especially the government and legislators, must comprehensively analyze various existing market structures and impact of each decision on the economy. For instance, the government must understand the danger of under-regulating and over-regulating oligopolistic firms. The government must weigh benefits of deregulating monopolistic industry against maintaining the status quo. Since most monopolistic firms are fully or partially government-owned, the government should understand dangers of price discrimination. Price discrimination is a dominant competitive pressure on firms operating in markets marked with high barriers to entry. Price discrimination refers to a scenario when a producer charges different prices for the same good or service. Producers or sellers must identify and separate a minimum of two groups with different elasticity of demand in order to profit from price segregation. In addition to the above requirement, sellers must make sure that buyers purchasing at a low price do not resell goods to consumers at higher prices. All the above markets are amalgamated in the local economy and interact with international economies through international trade. The impact of international trade should be aimed at spurring quality regulation and legislation by the state thanks to extensive understanding of these markets.