Resource-based strategy (RBS), also known as the resource-based view (RBV), emphasizes the manner and reasons why resources play a crucial role in a successful corporate strategy. Armstrong and Shimizu (2007) observed that, if used appropriately, the RBS guarantees to attain substantial gains, values or competitiveness. However, Baker and Nelson (2005) contended that based on the framework of perfect competition, sustainable competitive advantage can rarely be achieved in the long run. On the other hand, under monopolistic competition, the possibility of earning abnormal profits remains. Apart from describing the RBS model, the paper also explores its strengths and weaknesses.

The Notion of Resource-Based Strategy

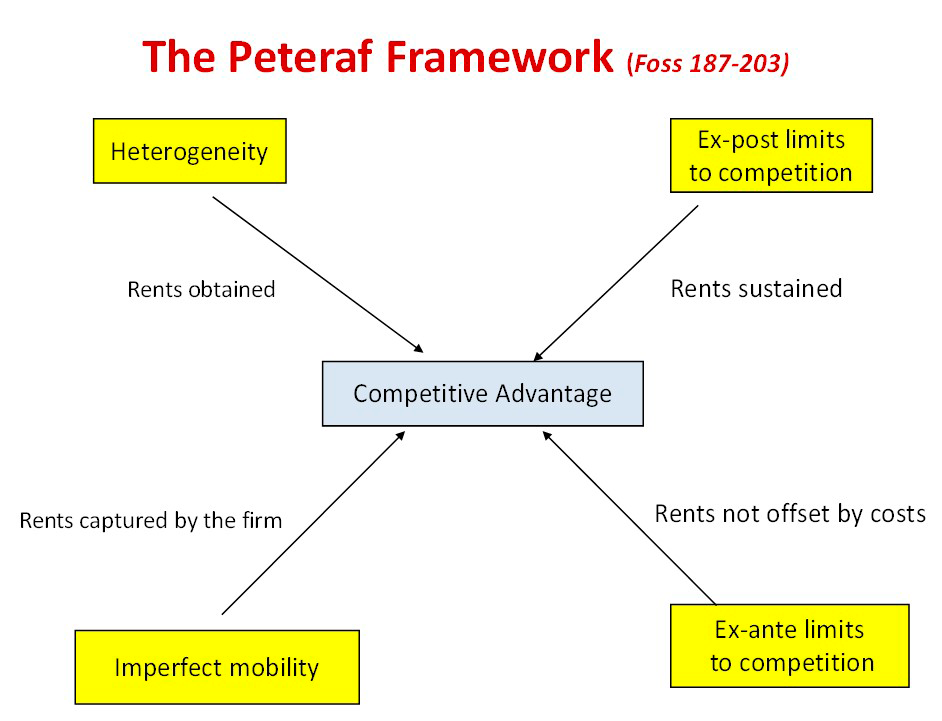

In the subsequent step, the focus is on displaying the key attributes of the resource-based view of the firm. The following framework is critical in understanding the resource-based strategy.

In terms of heterogeneity, firms’ resources differ in various aspects although all of them generate rents. In ordinary circumstances, rents from land vary due to different reasons such as fertility levels. Such differences have been applied to resources other than land. Ex Post Limits to Competition also contributes to the understanding of the strategy. Apart from occupying a superior position that facilitates earning extra rent, other forces must be in action to limit competition in the area of operation. For instance, imperfect imitation is one of the factors that contribute to limitations on the competition. Isolating mechanisms and causal ambiguity are among the other contributing factors that undermine competition, leading to the generation of above-average earnings. Imperfect mobility is closely linked to the issue of imperfect imitation. However, in this regard, reference is made to specific difficulties encountered by a company in switching resources. In this case, the cost attributed to switching resources across different firms or industries is limited. Thus, there exists a possibility of earning excess profits due to the fact that companies are reluctant to establish production ventures.

Ex-ante limits also play a significant role in limiting competition levels within a given sector. Before an entity acquires a position of influence, there is little competition in the industry in question. Distinguishing features that lead to rent gaining include inimitability, path dependency, durability, physical uniqueness, causal ambiguity, and low substitutability. However, the main attribute is that distinctive capabilities account for competitive advantage. In this regard, it is acknowledged that heterogeneous resources exhibit distinctiveness. Such uniqueness is attainable in architecture, innovation, reputational and possession of strategic assets. In architecture, contracting issues such as spot contracts, classical contracts, and relational contracts assume significance.

The rivalry between the American Apple Inc. entity and the Korean Samsung Electronics is illustrative of the RBV strategy. The two companies operate in the same environment and thus are exposed to similar external forces. However, the difference in their resources implies that they achieve different results. Both companies compete on smartphones and tablets, however, Apple charges higher prices for its products and thus enjoys bigger profits. Although Apple’s products might not outweigh in terms of quality, Samsung cannot apply the same strategy because Apple has taken time to build its reputation.

Based on the RBV framework, higher feasibility exists in a bid to exploit external opportunities through the employment of existing resources in an innovative manner as opposed to bidding to acquire novel skills for every opportunity that emerges. Under the RBV framework, resources play a critical role in improving the organizational performance of a company. Foss and Foss (2008) observed that the model advocates for viewing resources as either tangible or intangible. Whereas tangible assets are physical, intangible assets lack a material form. Tangible assets include capital, equipment, machinery, land, and buildings, while intangible resources include brand reputation, intellectual property, and trademarks. While physical resources can be availed at markets, they yield limited advantage to a company in the long-run. By contrast, intangible assets depend on what the company does for a long time. Thus, they constitute the main drivers of competitive advantage.

RBS and Efficiency in Markets

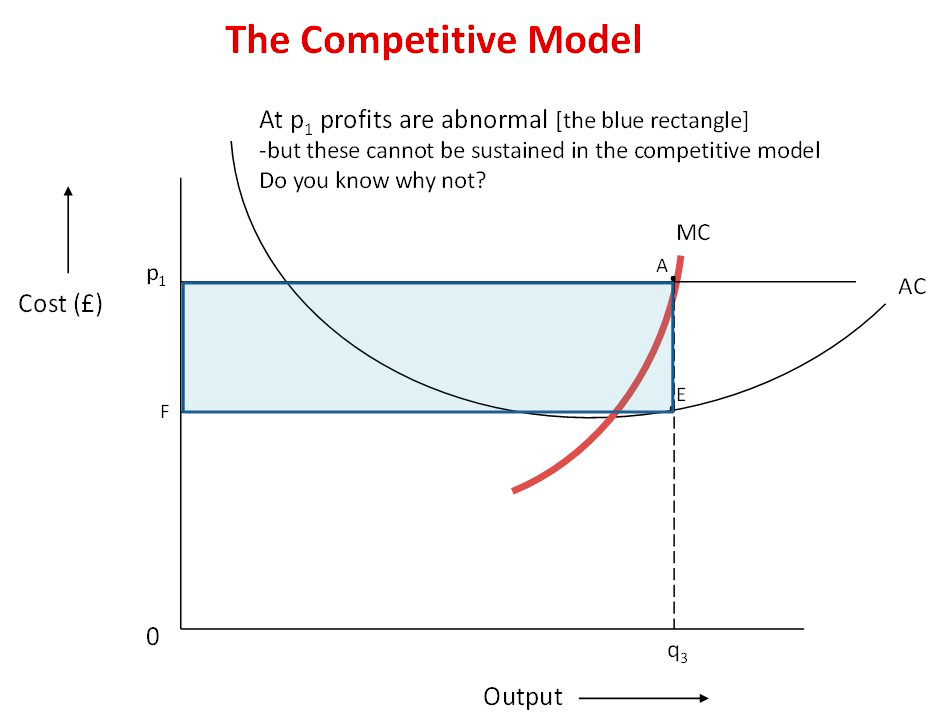

The primary aim of any successful strategy is the creation of a sustainable competitive strategy. Although the RBV theory suggests that it is possible to earn extra profits in the long term, the efficient market hypothesis does not align with the position. Based on the latter position, competition takes place even within an environment of a few firms. As a result, if there is one firm that is earning excess profits, the other participants of the market will engage in efforts to copy the competitive approach, and, ultimately, the edge will be erased. Barney and Clark (2007) also noted that although the possession of unique resources is possible, they cannot be sustained over a long period of time. In this regard, reference is made to the idea that asset costs are not static. Prices change over time, with the possibility of price reduction being high. It is also noted that given a high level of dynamism within any industry, innovations emerge over time, which in many instances render the existing ones less competitive or obsolete. Consequently, the possibility of earning excess profits in the long-run based on the possession of unique resources is questionable.

The graph below is useful in highlighting that in the long-run, it is not possible to earn abnormal profits within a competitive environment characterized by perfect market conditions.

Limitations/ Weaknesses

Without any doubt, the resource-based view offers a useful framework that aids in the understanding of strategy formulation and application across organizations. However, just like any model it also has some limitations. For instance, with closer scrutiny of the framework, it becomes evident that without proper integration of the approach into a firm’s competitive environment some concerns might emerge. In particular, the unit of analysis, the theory’s tautological nature, negligence of environmental factors, exogenous aspect of value, the status of heterogeneity and other assumptions on inimitability cause problems.

The RBV method does not overcome the general problem associated with establishing a suitable unit of analysis. Thus, it is not surprising that many contributions to the theory assume that an individual resource is the appropriate focal unit when studying competitive advantages. However, such a choice is legitimate only if all the relevant resources are defined as sufficient and independent from each other. On the contrary, resources depict a strong association in terms of complementarity or co-specialization. The manner in which resources are interconnected plays a significant role in the emergence of competitive advantage. More importantly, the extent to which a collective cluster of resources fits into an organizational system is critical in the establishment of competitiveness.

RBV’s exogenous basis is also highly questionable. According to Foss, Foss, Klein, and Klein (2007), the determination of the value of resources of a firm is exogenous to the model. The tautology accompanied by the exogenous value determination negates or minimizes the contribution of the framework in reference to explaining competitive advantage. Foss (2007) observed the need to address the link between a resource and its environment gave that resources reflect what is doable to compete in a bid to satisfy the customer’s needs effectively. Moreover, RBV needs to limit its application domain to firms given that it can introduce fine ingrained analyses towards the comprehension of the dynamics that characterize industries. For example, the model can direct attention to resources that underlie mobility barriers or entry into an industry. Ghoshal (2005) also noted that RBV focuses on the lack of the ability of rivals to match or erode the dominant position held by an entity as a requisite condition for the sustainability of the competitive edge. The theory assumes that rivals can erode the position without any restraint. In practice, it is not reflective of the prevailing conditions in competitive industries.

RBV and the Lack of Its Managerial Applicability

The RBV framework encounters much criticism that underlies its weakness as well as its strengths. According to Gibbert (2006), the theory is poorly advanced because it lacks substantial implications for management. In other words, the model has no operational validity. Asking managers to provide VRIN resources as well as an appropriate organization is commendable. However, being silent on how it should be achieved is a major weakness. Additionally, the RBV invokes the idea of total control, which trivializes issues pertaining to property rights besides exaggerating the degree to which management has control over resources, or are in a position to foresee events. Lado et al. (2006) also determined that RBV is deficient based on the tension it creates regarding descriptive and prescriptive theory.

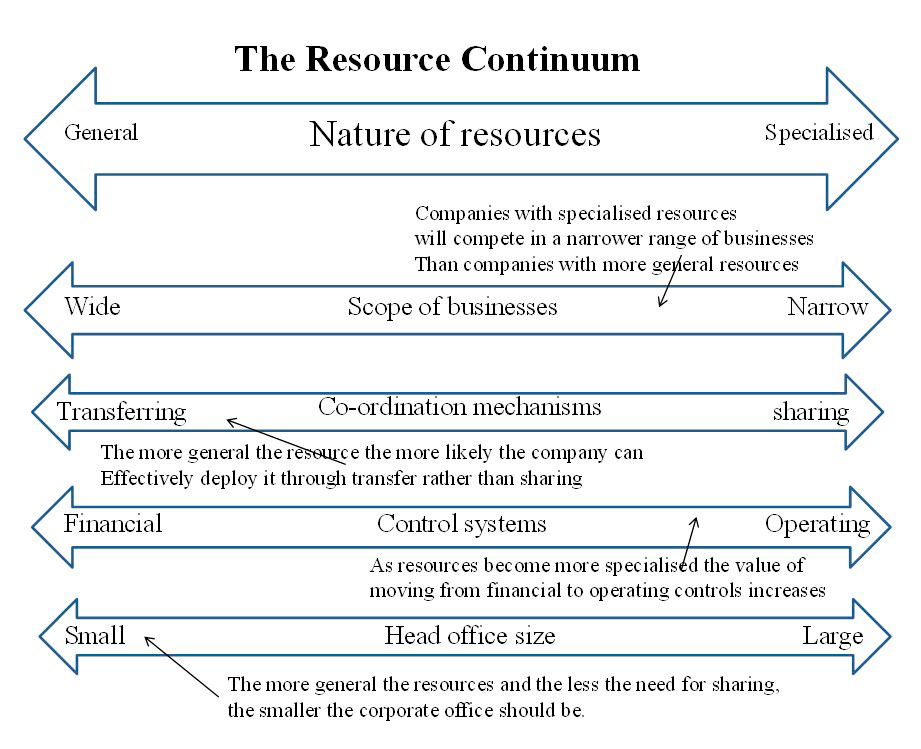

According to the resource continuum diagram, resources have different attributes/ aspects that make them more or less productive. The implication is that the way in which entities/ firms employ resources to influence the extent to which they pave the way for the realization of competitive advantage.

According to some scholars such as Foss and Foss (2008), RBV involves infinite regression. The position is supported by the view that developing better structures that produce better products is preferred for product innovation. Thus, an entity that is engaged in updating its production capabilities rather than in product innovation is likely to assume dominance with time. The essence is that firms are always in an endless pursuit of high-order capabilities. In an abstract sense, such an endeavor might be true, yet the critique fails to achieve its purpose. Applied theories do not have many levels of analysis. For every shift across levels, the analysis deviates further from empiricism and practicality. Like in the above case, introducing another level of analysis would make the theory artificial without any sense.

Lado et al. (2006) allay concerns that those obsessed with infinite regression focus on economic science or management as a positivistic exercise in pursuit of certainty. The moment it is acknowledged that strategic management is a practical engagement between open-mindedness and indeterminacy, the critique collapses. Instead of perceiving high-order capability as superior to low-order capability, attention should be focused on managing interactions between the two. In particular, there is a need to assess the association between operational and meta-competencies. The two capabilities should be mutually supportive.

The third critique of the RBV model lies in the argument that it has three versions. According to Gibbert (2006), resource uniqueness, heterogeneity meddling, and immobility limit the theory from possible generalizations. It is evident that the possibility of generalizing aspects such as uniqueness does not exist. Based on this finding, the inability to generalize is the major limitation or weakness of the framework. However, such assessments have been termed as academic-oriented rather than field-based. According to Foss (2007), there remains a possibility of generating helpful insight about aspects/ characteristics of uniqueness.

Gibbert (2006) contended that the RBV model is only applicable to large organizations that hold a considerable market share. In this regard, small firms are viewed as having static resources that do not meet the parameters explored by the theory. Although the assertion has some weight, the argument is invalid when paying attention to intangible resources such as reputation. In practice, big firms are likely to have huge tangible resources compared to small ones; however, it might not be the case in regards to intangible assets. Overall, it is held that by focusing on big entities or dominant players, RBV ignores another important segment of the business community.

Another issue that highlights the weakness of the theory is the sustainability debate. In practice, firms need to acquire rare resources with a promise of generating substantial gains. In many instances, firms that already possess VRIN resources are well-positioned to acquire such capabilities. Otherwise, any other player is likely to acquire the resources, leading to the absence of a competitive edge. Based on the RBV model, firms follow a path where the past plays a major role in influencing the future. Despite the applicability of the theory to understanding many cases of dominance, the model might not explain the meteoric rise of companies. Therefore, the model is limited in explaining peculiarities within business circles.

Strengths of the Framework

Despite the listing of a number of weaknesses above, the framework has advantages too. According to Hodgson (2008), the above criticism is unjustified given that the theory aspires to explain competitive advantages that present in some firms but are lacking in others. As a result, it is arguable that the theory was never intended to yield management prescriptions. Thus, any explanations emanating from the theory are indicative and valuable to managers. In essence, nobody can force a theorist to generate theoretical implications. According to Ghoshal (2005), it would be useful to divert attention to the role of the theory in impacting management practice. In this regard, the influence the framework has on practice counts as its strength.

One of the strengths of the resource-based view lies in its approach to understanding the competitive advantage. According to Acedo, Barroso, and Galan (2006), RBV adopts an inside-out approach to assessing firms. Using the method, the RBV model manages to highlight attributes that are exclusive to firms that play a major role in dominance. For instance, some components, such as those that allow adding value across the value chain, contribute to building a competitive position. Similarly, developing new products and expanding into the emerging markets constitute some of the attributes the specificity of which leads to the generation of competitive advantage. The platform also helps assessors of firm performance to understand that not every resource contributes to the advancement of the competitiveness of a firm. Alternatively, each resource contributes differently to the competitive position that a firm scales. Thus, the theory shows considerable strength as it emphasizes that a competitive advantage emerges when resource heterogeneity and immobility are effective.

It is a useful framework for exploring a competitive advantage. By taking the resource perspective, the RBV introduces assets/resources as critical components in the process of strategy formulation with a view to attaining competitiveness. Without a doubt, resources are critical to the progression chances of an entity. By exploring the resource aspect of developing competitiveness, the theory plays a significant role in the understanding of the dominance of firms based on their possession of superior resources.

The fact that the RBV is among the most frequently cited theories regarding management history implies that it is highly influential. It is also apparent that the framework aspires to highlight and explain a sustained competitive advantage. By observing that for a firm to attain sustainable competitive advantage, it must possess Valuable, Rare, Inimitable and Non-substitutable (VRIN) resources, the theory makes a critical contribution to the topic. Irrespective of the appropriateness of observation, the model eases the understanding of a sustainable competitive advantage. The theory also demonstrates its strength based on its simplicity as well as face validity. The core message advanced by the theory is appealing and easy to understand. Despite such strengths, the model is largely criticized because of various shortcomings. Despite extensive criticism, RBV shows resilience in responding to it.

By putting the core determinants of the firm outside or in the external environment, the theory brings another dimension to the operations and performance of organizations. It is evident that the external environment influences firms’ performance. As a result, the theory is appropriate and reflective of the reality as far as the firm is concerned while operating in any given circumstances.

Based on the review of the RBV model, it appears that clinging to inappropriate narrow neo-classical economic rationality diminishes the opportunities to advance. In the absence of innovation, no entity can sustain or create a competitive advantage. Although the theory is useful in understanding competitive advantage, its limitations such as the inability to proffer management implications reduce its reliability. Regarding its core strengths, the model is crucial in explaining sustained market dominants by certain firms. However, the RBS framework is criticized by the efficiency market, which posits that earning excess profits is not possible unless market conditions are perfect.